FABA

The first venture capital token with a positive impact on life

FABA is a bean token that captures startup networks with the traditional funding market. FABA monetary supports organizations with positive effects on the environment, ecology, medicine, education. We connect funding with crypto networks so that we get significant input on our efforts to put resources into and on the opposite side to get new assignments from the network to be supported. There will be an application that can be accessed by Faba token holders, who will empower to filter our speculations.

Benefits are part of the FABA Project:

Behind the Faba tokens there are original VC organizations with interesting project arrangements, which besides benefits related to the money they do positively affect our environment. Holders obtain Faba tokens with privileges for dividends, which have an attractive rate of return (ROI) and development of high valuation potential. Based on assets taken from the organization’s share value permit, the benefit level will be disseminated and paid to the Faba token holder as an ETH digital currency into the ETH wallet.

Behind the Faba tokens there are original VC organizations with interesting project arrangements, which besides benefits related to the money they do positively affect our environment. Holders obtain Faba tokens with privileges for dividends, which have an attractive rate of return (ROI) and development of high valuation potential. Based on assets taken from the organization’s share value permit, the benefit level will be disseminated and paid to the Faba token holder as an ETH digital currency into the ETH wallet.

Advantage

Profits will be distributed fairly based on the shares sold in the Faba investment portfolio. Profit distribution will be

published first in a press release on the Faba website. The press release will include the name of the

company that came out, the conditions in which the company was sold, cash flow and date of payment. Profits

will be distributed in ETH to the ETH token wallet (FABA). It will always be paid when

receiving funds for shares sold by the company.

After registering a token (FABA) on the stock market, we will promote the value (FABA) of tokens with

sustainable global marketing from each project invested by Faba.

published first in a press release on the Faba website. The press release will include the name of the

company that came out, the conditions in which the company was sold, cash flow and date of payment. Profits

will be distributed in ETH to the ETH token wallet (FABA). It will always be paid when

receiving funds for shares sold by the company.

After registering a token (FABA) on the stock market, we will promote the value (FABA) of tokens with

sustainable global marketing from each project invested by Faba.

Potential project evaluation

The process of selecting a suitable project starts with an analysis of the basic form filled in by the

applicant on our web page: vc.fabainvest.com

After the project matches the Faba investment strategy based on an investment memorandum and meets

the following criteria: business segment, market, global expansion and the size of the investment needed, then

invited to the elevator pitch presentation to be introduced. The presentation is evaluated by the mentor (people who

have a proven track record of building and selling their own company, or who have been in

top management positions), they ask questions and provide feedback to the project. At the end of the presentation, choose a mentor if

the project can pass to the next round of assessment.

More than 50% of the votes determine. In each project, the business plan and core team are

evaluated. Products or services can always change in their journey, but the CEO and his team are

the most important factors. Following is the publication of a successful elevator pitch in the application – the blockchain,

where (FABA) token holders (having a 2000 FABA minimum token) provide feedback when potential consumers and

together with the Faba team make investment decisions.

The process of selecting a suitable project starts with an analysis of the basic form filled in by the

applicant on our web page: vc.fabainvest.com

After the project matches the Faba investment strategy based on an investment memorandum and meets

the following criteria: business segment, market, global expansion and the size of the investment needed, then

invited to the elevator pitch presentation to be introduced. The presentation is evaluated by the mentor (people who

have a proven track record of building and selling their own company, or who have been in

top management positions), they ask questions and provide feedback to the project. At the end of the presentation, choose a mentor if

the project can pass to the next round of assessment.

More than 50% of the votes determine. In each project, the business plan and core team are

evaluated. Products or services can always change in their journey, but the CEO and his team are

the most important factors. Following is the publication of a successful elevator pitch in the application – the blockchain,

where (FABA) token holders (having a 2000 FABA minimum token) provide feedback when potential consumers and

together with the Faba team make investment decisions.

Security or Utility Tokens?

The majority of tokens released in 2017 are claimed as utility tokens to be refused friction with the SEC but upon approval, they are security tokens.

Utility Token

Utility tokens are also referred to as application tokens, gift tokens or user tokens. These tokens are usually issued by companies to fund the development of their projects, services or products offered. The value of utility tokens is verified against the value for their concept in the future.

There are several good usage options for utility tokens (games, gifts, software usage, etc.) The tokens they make are reasonable, or if they make interesting claims (you need to be challenging) You might want to see shitcoin tokens or empty ges .

According to Manzo Porelli in the Urban Dictionary, shitcoin or shit coin is “A cryptocurrency without unique utilities or features.” And according to Bustapost, also in the Urban Dictionary, use the right term in the sentence “See that person there, in the refrigerator box? Everything is lost in the 2018 shitcoin accident. “

Many projects require scale to make projects successful, they need to adopt them, and most end users don’t need to, mostly, if you are a decentralized application or can be built on the blockchain. without having to take my US dollar, open a digital wallet, buy new crypto currencies and, after bank verification, etc.

To clarify – security tokens, it is not necessarily better to invest from utility tokens or vice versa. Research is very important in every investment decision and you should not invest if you cannot forget everything.

Security token

Public security tokens that are supported by real estate assets, limited partnership company shares, or trade. Token holder. Security tokens have been developed to empower traditional IPOs over blockchain technology. Security tokens also depend on federal regulations.

Security tokens are used to pay dividends, share profits, buy interest, or buy in tokens or other assets to gain profits for token holders. This is a financial instrument that can be traded with monetary value. Public Equity, Personal Equity, Real Estate, Managed Funds, Traded Funds, Bonds are common examples of security tokens.

What is appreciated by people in the cryptocurrency industry heard their compilation of hearing the news about how many millions of crypto could be recovered or what they heard about many ‘projects’ that collected dollars and started starting total projects. This is the reason many people in this industry are very interested in the security and regulations around them. Those who are entitled to STO will help legitimize this industry.

The power of the blockchain will provide much-needed change for industry and innovators, traditional investors and emerging companies for a completely new market to acquire wealth and change the way the financial world is democratized.

There are many benefits in the current market funds with crypto through security stores, including increased loans sold and international investments and projects that can attract more investors around the world.

Security tokens can be real estate, funds, hotels, licenses, restaurant chains, etc. It would be interesting to see what tokens for the following year.

ICO Bonus Program

Conclusion:

ICO’s soon took authenticity as being prominent among other courses for new companies to raise capital, especially if they were in the blockchain business. If you want to put resources into cryptographic money, it is important for you to know the difference between coins and tokens, which is why you must have the capacity to notify utility tokens, separate security tokens of various types of tokens. Having a general understanding of how this superiority functions will accomplish work, but what isolates sharp financial specialists from normal speculators is understanding the intricacies of many sides that classify typical tokens and coins. As always, contributions are cheerful!

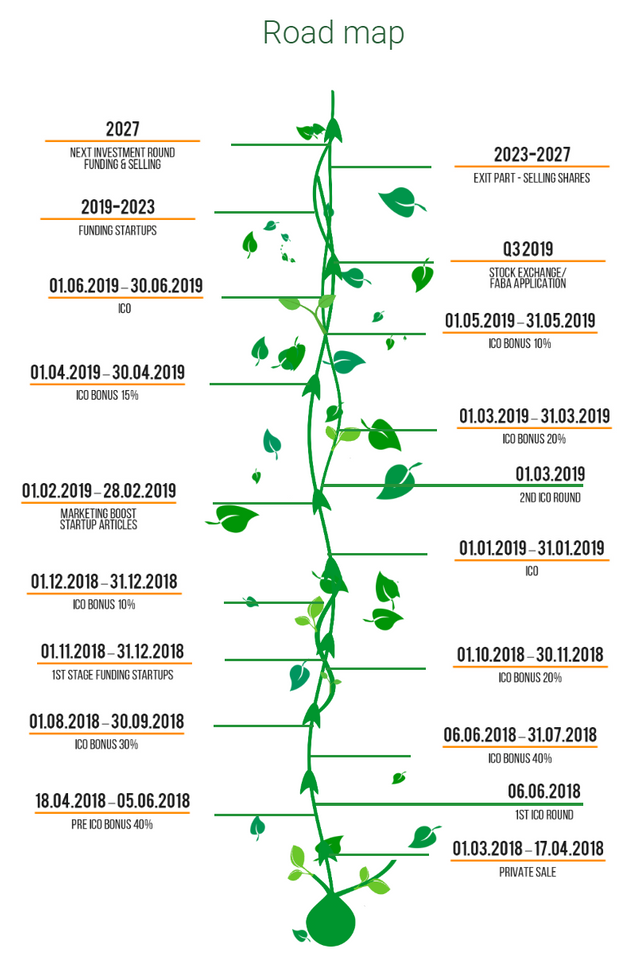

Roadmap

Tim

Further information:

Website: https://vc.fabainvest.com/

Whitepaper: https://www.faba-white-paper.com/FABA.pdf

ANNThread: https://bitcointalk.org/index.php?topic=5067299.0

Telegram : http://t.me/fabaventurecapital

Facebook: https://www.facebook.com/fabainvest/

Twitter: https://twitter.com/FabaInvest

Whitepaper: https://www.faba-white-paper.com/FABA.pdf

ANNThread: https://bitcointalk.org/index.php?topic=5067299.0

Telegram : http://t.me/fabaventurecapital

Facebook: https://www.facebook.com/fabainvest/

Twitter: https://twitter.com/FabaInvest

by ; Kopisusu 4000

link: : https://bitcointalk.org/index.php?action=profile;u=1953415

link: : https://bitcointalk.org/index.php?action=profile;u=1953415

Tidak ada komentar:

Posting Komentar