Svandis Guarantees Digital Asset Owners a Trading Information Platform with Transparency and Real Time Feedback

In recent times the decentralized economy has been a place of great achievement to all users of crypto currencies, steadily increasing in adoption. This has led to many people choosing to participate in a decentralized economy. In as much as there is an exponential growth in the number of crypto assets which moves along with the invention of new tokens also known as initial coin offering (ICO), investors are beginning to doubt the legitimacy of these offering due to the recent scams.

Market observers have also been hoping to have the utility token sale migrated to tokenized equity thereby bridging the gap between contributors and shareholders, letting token owners have comparable rights such as reporting rights, voting rights, pro-data-follow on rights, liquidity preference, exit and dividend participation etc.

In November 2017, the estimated number of accounts on Coinbase a digital exchange asset platform, stood at 13 million users. According to Reuters, the total number of hedge fund centered on trading digital asset had doubled by February 2018. Regardless of the fact that there are many companies who wants to bridge the gap, there is still a shortage of expertise to assist traders and investors in choosing tokens for trading, finding credible and reliable initial coin offering (ICO) to invest in. Also professional news service for feedbacks and updates also remains a huge challenge. This makes the activities of an investor tedious and time consuming.

In their 11th yearly global hedge funds and investors survey (EY), it was revealed that the hedge fund industry spends an estimate of 2.3 billion dollars annually on blockchain technology which has led Svandis to take a bold step in institutionalizing the crypto asset.

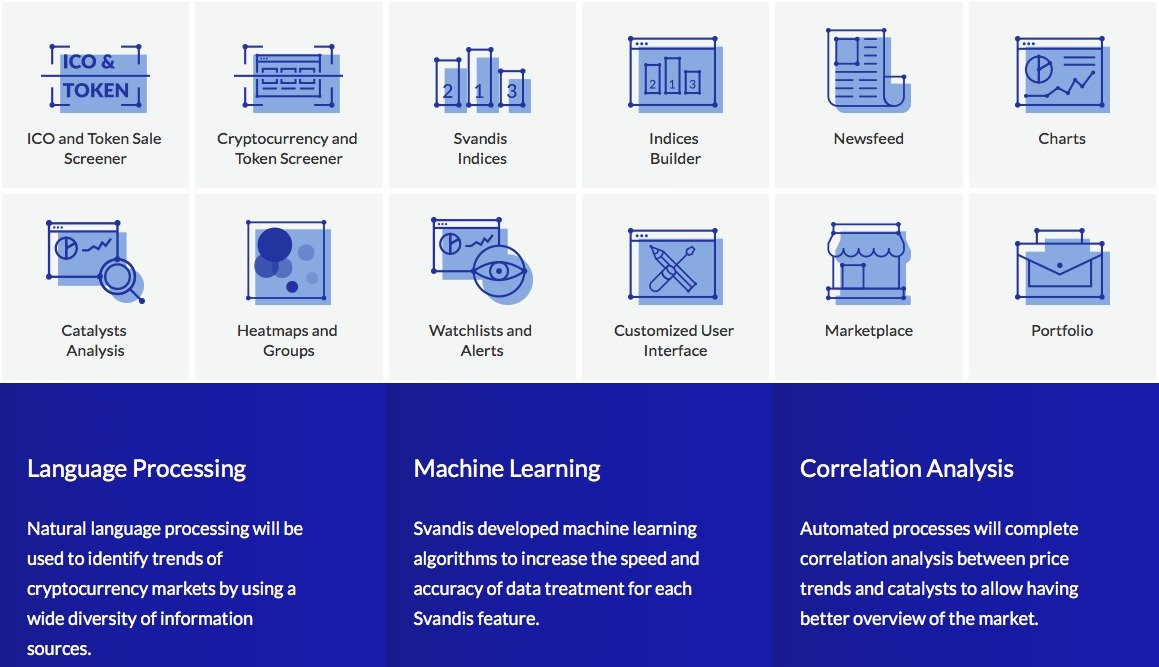

Svandis is a decentralized system that comprises of the research community (external analyst, researchers), Svandis development community (external developers, data scientist) and the token holders, client and participation points (traders, analyst, hedge fund and institutional investors, proprietary trading firm, venture capital funds, token sales contributors, exchange).

Tidak ada komentar:

Posting Komentar